The answer to this question typically starts with, “it depends.” It’s hard to find this information online because your business is unique and has unique exposures. What I can tell you is how you can determine what types of insurance your business needs.

Insurance is very often confusing, but it doesn’t have to be.

Why it’s hard to find an easy answer

Getting a good answer to this question isn’t easy – at least if you want to be covered in the right way.

One of these reasons is that there are a lot of different types of insurance policies. These include:

- General Liability

- Business Owners Policy

- Property Coverage

- Commercial Package Policy

- Workers Compensation

- Commercial Auto

- Umbrella

- Inland Marine

- Professional Liability

- Directors & Officers

- Management Liability

- Employment Practices Liability

- Fiduciary Liability

- Cyber Insurance

There are definitely more than what I’ve listed here. Some types of insurance can cover the same thing as others, but from a different perspective. I think the point here is evident: insurance is not a simple thing.

Add in the fact that different types business have different needs. For example:

- A Contractor may have a significant exposure to General Liability and Workers Comp, with limited exposure to Cyber related losses.

- A Medical Office office may have significant Cyber Insurance exposure and little to no Auto Liability exposure.

- A Restaurant may have a need for nearly all of these coverages, but in varying amounts based on how the business is run.

When you add in that each business within a specific industry can operate differently from others that are similar to them, it makes near impossible to find accurate information on your own.

The role of your insurance broker

Your insurance broker exists to not only place the insurance coverage that you need, but to help you identify where you’re at risk so that the insurance coverage you place actually protects you from financial loss. It’s a consultative – not a transactional – process.

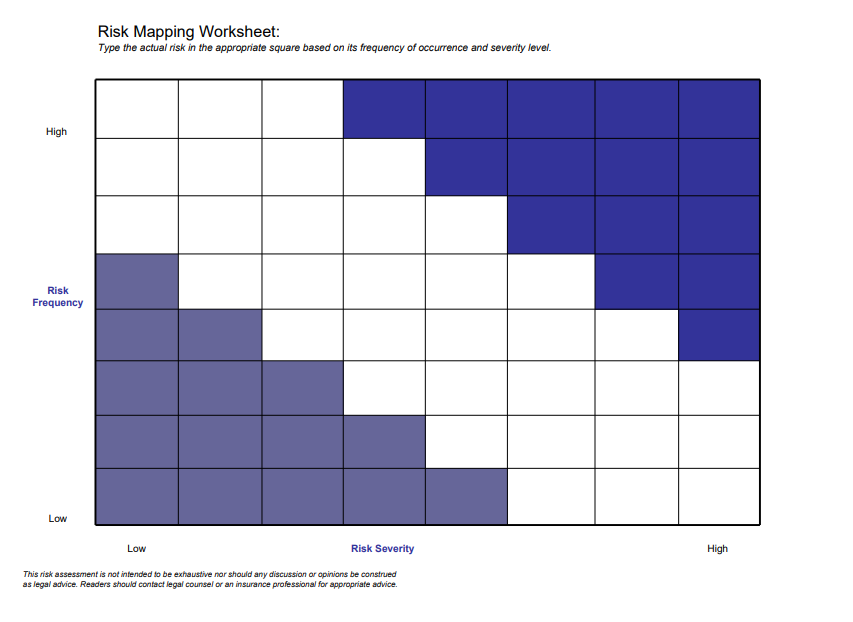

The way this is done correctly is to perform a risk assessment on your business, specific to your industry. Following a risk assessment, you and your broker work together to identify what risks can be retained, which can be controlled, which can be transferred (insurance) and which should be avoided.

Note that insurance is only one of these things. When viewed in a risk management framework, the application of insurance becomes easier to understand because there is context.

Is this the experience you’ve had?

The power of the Risk Assessment

Scroll back up and look at that list of different types of insurance policies – how are you supposed to determine what coverage you need on your own?

This is the power of the Risk Assessment:

- Clarity

Risks do not fail to exist simply because we ignore them. Through the risk assessment, you’ll have a framework through which your risk is more easily seen and understood. - Knowledge

Humans make the complicated less so through formal processes. The risk assessment is a formal process that helps inform your decision-making in regard to a confusing topic. - Preparation

There are a seemingly endless number of things you can do to prepare for tomorrow, but you cannot do everything at once. By identifying the most significant risks you face, you can address them systematically to better protect your business both now and in the future. - Cost Reduction

This isn’t quoting your insurance to see if you can get a better premium. This is a long term plan for reducing your Total Cost of Risk – this is a better way to directly affect your bottom line and increase profitability.

When was the last time you completed a risk survey?