For a long time, the Property & Casualty Insurance market was in a soft market. Even before COVID-19, the market was hardening, but like so many things, COVID-19 accelerated something already under rapid change. So what does a hard insurance market mean to you?

To frame the conversation, I’ll first define some terms so that we’re all talking about the same thing. Then I’ll get into a general overview of the market followed by what you can do about it.

While much of what’s going on in the insurance market is out of your control, you do have the ability to control your risk-related costs more than you may realize.

Quick Definitions

A soft market is the prototypical “Buyer’s Market.” The pricing of the product or service you’re buying is at least stable, and even lowering it’s costs over time. In insurance, a soft market is characterized by decreasing rates, broader coverage terms for little or no extra cost, and an easier underwriting environment.

A hard market is often considered a “Seller’s Market.” Most typically, this is characterized by increased pricing. In insurance, the traits of a hard market include: rising rates and premiums (sometimes by double digit percentages), stricter underwriting (it becomes harder to get coverage), less overall capacity to take on risk from carriers, narrower coverage terms, and generally less competition between carriers.

Your business might see a significant premium increase on a policy where the pricing has remained largely unchanged for years. If you have ‘higher risk’ operations, conditional or non-renewal notices may become commonplace.

Market Overview

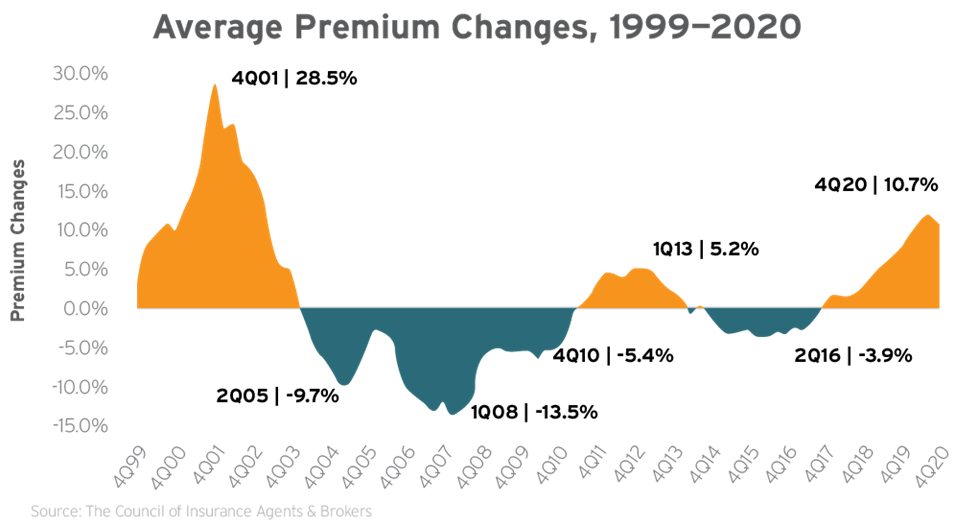

It’s been nearly 20 years since the last real hard market for insurance. Much has changed in the past two decades, so we’re living in some uncertainty here.

The specific lines of insurance coverage that are being hit the hardest are:

- Directors & Officers Liability

- Public Entities are seeing rate increases of between 20% – 70%

- Private Entities will likely see between 10% – 50% increases

- Employment Practices Liability

- Between 10% – 30% increases

- Excess & Umbrella Insurance

- 30% or more

- Higher Risk operations might see increases of 50% or more

- Commercial Property

- High Risk or Catastrophe (natural disaster) exposed risks may see rate increased of 25% or more

- Commercial Auto

- Increases of 5% – 25%

- Cyber Liability

- Increases of 10% – 30%

The major lines of insurance coverage not in the above outline are General Liability and Workers Compensation. These lines will likely still increase, but at lower and more stable factors. Of course, if you’re in a higher risk operation, you could still see significant increases on these policies.

Even with the uncertainty surrounding future pricing, there are a few things you can do to help mitigate your own insurance and risk related costs.

How to Navigate an Uncertain Market

Proactive Risk Management is Key

The best premiums and coverage terms are going to be reserved for what the insurance companies consider the “best risks.” It is therefore vital to know what the underwriters are looking for and give them what they need:

- Complete and Accurate Information

For most businesses with less than $1M in revenue, you’re still going to be able to get insurance coverage with little information. Most of the underwriting at this level is automated and an actual underwriter may not really get involved. However, if you business is earning $1M in revenue or more, you’ll need to come prepared. Without complete information, you’re most likely not getting a quote. - Proactive Risk Mitigation

Do you know the most likely causes of financial loss to your business? What types of things are you doing to mitigate the likelihood or severity of loss in these areas? What type of Risk Management plan do you have in place – or are your insurance policies your risk management plan? Having evidence of what your business is doing to prevent and limit losses carries a lot of weight.

Telling a Story

- Create a Narrative

Humans communicate best through stories. It’s important not to overlook the fact that the underwriter looking at your account is human, too. To get you the best coverage and pricing options, we need to tell the underwriter a story about your business. There’s nothing new about this – the importance of it is just exacerbated by the hardening market. - Develop your Risk Profile

What parts of your business are you working to improve? A good risk management plan helps to support your business goals around improving your operations or increasing profitability. If you haven’t yet been looking at how you handle your risk strategically, now is the time to get started.

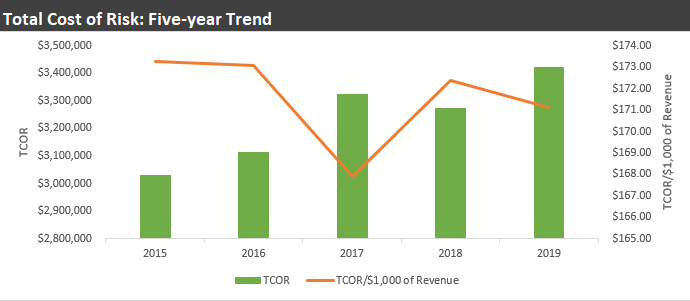

Total Cost of Risk

- Whether you’re measuring it or not, your business has a Total Cost of Risk of which insurance premiums is only a small part. When you start to look at your insurance premiums through the lens of Total Cost of Risk, you will find a more analytical approach to decision making regarding your risk. In blending the science of Total Cost of Risk with the Art of running your business, you’ll find a tool that will help you run your business more efficiently and more effectively.

At the start, Total Cost of Risk may look like this:

But after a while, it starts to look like this:

What’s Next?

Even if you’re insurance doesn’t renew, now is a great time to talk about these things. Often, we will work with our clients before technically writing any insurance for them so that when your policies come up for renewal, you’re well positioned to go to market.

You can contact me directly at (215) 499-5185 or at ryan.stillwell@stillwellriskpartners.com.

You can also book an appointment directly with me here: